IT bellwether Tata Consultancy Services recorded a 9% surge in fourth-quarter profit as revenues also saw a marginal rise. This and more in today’s ETtech Top 5.

Also in this letter:

■ Smartphone makers test GenAI on flagship devices

■ SaaS startup Postman acquires Orbit

■ ETtech Deals Digest

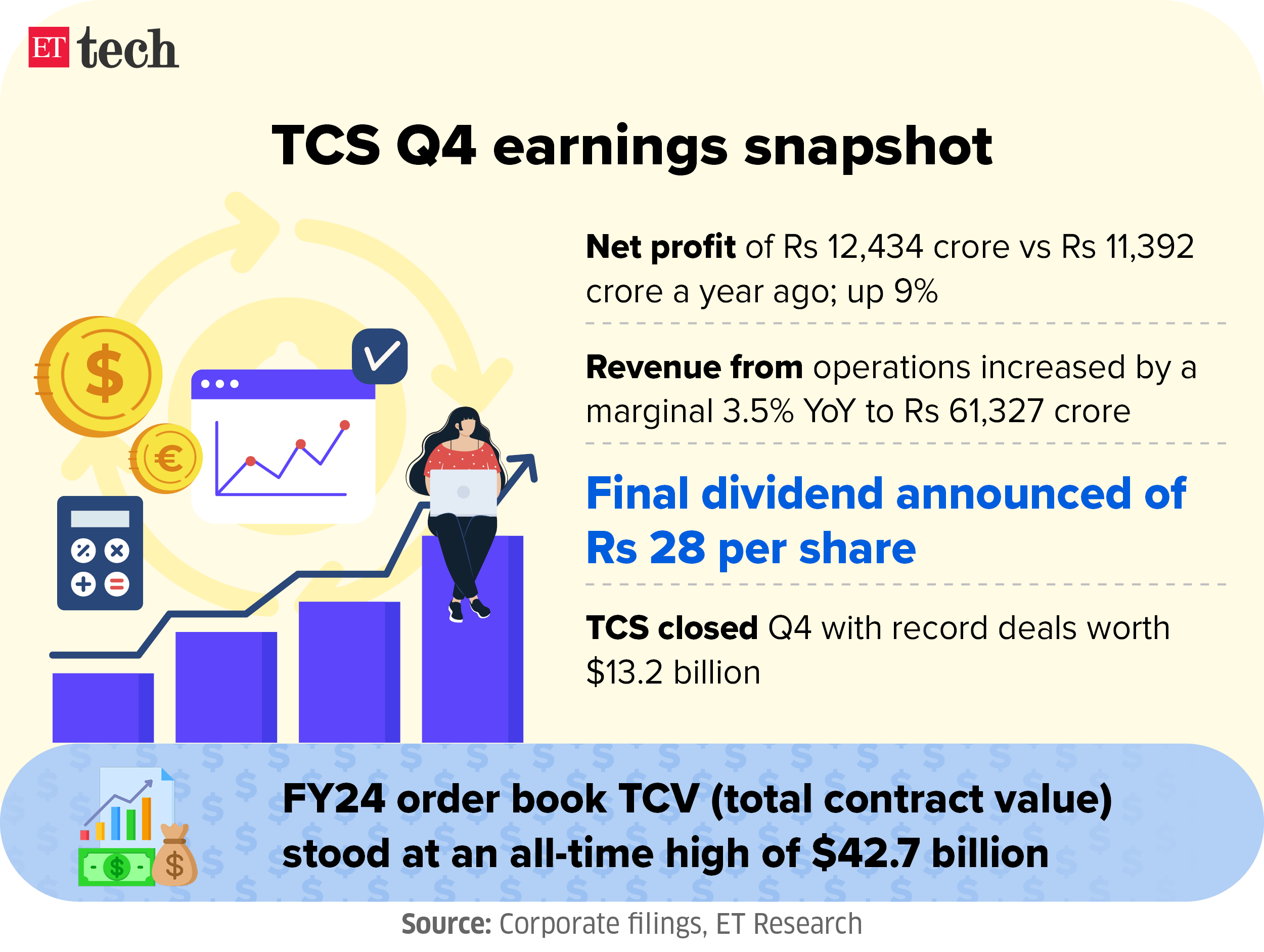

TCS Q4 profit rises 9% YoY to Rs 12,434 crore, beats estimates

TCS kicked off the fourth-quarter earnings season with a 9.1% growth in consolidated net profit to Rs 12,434 crore, compared to Rs 11,392 crore a year ago, surpassing estimates. The board has recommended a final dividend of Rs 28 per share. Let’s dive in with all the details.

Revenue uptick: Revenue from operations saw a marginal 3.5% year-on-year increase to Rs 61,327 crore. In constant currency terms, TCS clocked a revenue growth of 2.2% in the March quarter. The growth was led by the India business (up 38%), followed by the UK (6.2%).

Meanwhile, operating margins during Q4 expanded 150 basis points to 26%, while net margins improved 100 basis points to 20.3%.

Quote, unquote: “We are very pleased ending FY24 on a strong note with the highest-ever order book and a 26% operating margin, validating the robustness of our business model and execution excellence,” said K Krithivasan, CEO and MD, TCS.

Other highlights:

- TCS closed Q4 with record deals worth $13.2 billion

- FY24 order book TCV (total contract value) stood at an all-time high of $42.7 billion

- The BFSI segment, which brings the most revenue, degrew 3.2%

Hiring dips, attrition cools: TCS reported a dip on the hiring front in the fiscal fourth quarter. The company saw headcount decrease by 1,759 since the last quarter, ending the fiscal year at a headcount of 601,546.

Attrition for the last twelve months stood at 12.5%. In the third quarter, TCS had reported a sequential headcount dip of 5,680.

Lightspeed partners Abhishek Nag, Vaibhav Agrawal quit VC fund

Lightspeed partners Abhishek Nag (left) and Vaibhav Agrawal

Two partners at Lightspeed Venture Partners, which has backed startups such as Oyo, Byju’s, Udaan and ShareChat have quit the firm, adding to a slew of recent exits in the tech investment ecosystem, people aware of the developments told us.

Details: Vaibhav Agrawal, who was earlier with Lightspeed India and moved to the firm’s US partnership three years ago, quit in 2023, while Mumbai-based partner Abhishek Nag left in February. Agrawal is expected to set up his own investment fund, whereas Nag has joined 360 One to lead early-stage investments there.

Lightspeed in India: The firm has recently led large rounds such as the $103-million raise by audio platform Pocket FM in March, and a $41-million funding in artificial intelligence startup Sarvam AI. In July 2022, Lightspeed raised $500 million for its fourth fund focused on investments in India and Southeast Asia.

Large bets: Some of the portfolio companies on which Lightspeed has taken larger bets – including business-to-business ecommerce firm Udaan and vernacular social media platform ShareChat – have seen their valuations come down.

Udaan’s valuation fell to $1.8 billion after a $340-million financing round in December 2023. Lightspeed holds almost 40% stake in the company, which had a peak valuation of $3.2 billion following its January 2021 fundraise.

Churn at VC firms: The departures come in the backdrop of several top executives and partners in the tech investment ecosystem leaving their firms.

- Nexus Venture Partners’ Sameer Brij Verma

- Trifecta Capital’s partner Sandeep Bapat

- Lightbox Ventures partners Siddharth Talwar, Jeremy Wenokur and Prashant Mehta

- Orios Venture Partners – Anup Jain and Rajeev Suri

Smartphone majors are testing GenAI waters on their flagship devices

OnePlus, Oppo, Xiaomi and other top Chinese mobile phone brands have rolled out selective generative artificial intelligence-based applications in their flagship devices, suggest market trackers. The brands are testing the waters as competition heats up among handset makers to bring the newest technology fad into people’s pockets.

Who’s doing what?

- Samsung is working with Google to embed an on-device large-language model that provides AI use cases, including content creation, productivity enhancements, and image editing.

- Xiaomi has confirmed it will be rolling out an AI portrait feature that can be trained on a user’s face to generate any portrait photo

- Brands like OnePlus are quietly rolling out AI features, such as a magic eraser to remove unwanted objects in images powered by the company’s proprietary language model. Vivo also has a similar feature to the flagship handset launched earlier.

- Experts say Apple could soon jump on the Gen AI bandwagon with its own language model for iPhones, with an announcement expected during its annual developer conference in June.

Know thy context: Generative AI is expected to be the next big thing for smartphone brands to push upgrades in a market that is moving towards premium offerings.

Yes, but: “Everything about GenAI revolves around data. It is meant to offer a personalised experience. Now, data collection is a sensitive topic for most Chinese companies in India. They will want to make sure their policies regarding AI are watertight to avoid any legal hassle,” said Tarun Pathak, research director at Counterpoint Research.

Postman acquires Orbit to expand reach in software developer community

(From left) Postman cofounders Abhijit Kane, Abhinav Asthana and Ankit Sobti

Postman, an application programming interface (API) management platform for enterprises, has acquired Orbit, a tool developer companies use to grow communities across forums, chat platforms and social channels.

Tell me more: For the last four years, Orbit has helped top developer companies manage and grow their communities across platforms like Discord, Slack and GitHub, Postman said in a blog post.

At Postman, the Orbit team will help build community features into the Postman Public API Network so that publishers and consumers can actively collaborate.

Company details: The most valued Indian software-as-a-service (SaaS) startup at $5.6 billion, Postman provides an API collaboration platform used by over 30 million developers and 500,000 organisations.

Postman last raised $225 million in a funding round led by existing investor Insight Partners along with the participation of new backers such as Coatue, storied Silicon Valley investor Mary Meeker’s Bond Capital and Battery Ventures in 2021.

ETtech Deals Digest

Startup funding in the second week of April 2024 declined by about 80% from the same period a year ago, totalling $45 million across 10 deals.

Deal density in the latest week went down to about $4.5 million per deal, as per Tracxn data. During April 6 to April 12, 2023, startups had raised about $7.4 million per deal.

Funding was down sequentially as well, from $58.8 million across 20 funding rounds in the previous week.

Of the total corpus raised this week, artificial intelligence (AI) cloud and platform-as-a-service startup Neysa accounted for about 44%. It raised $20 million in a funding round led by Matrix Partners India, Nexus Venture Partners and NTTVC.

Seed-stage startups commanded 59.2%, raising $26.7 million. Early-stage startups raised $18.4 million, accounting for the remaining 40.8%. There were no late-stage or private equity deals through the week.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai.

6 months ago

62

6 months ago

62

English (US)

English (US)